Market Access in the Pharmaceutical Industry

Pharmaceutical market access teams exist to ensure effective medicines are available to the patients who need them. The patient access journey involves overcoming reimbursement and regulatory barriers to access, launching the product to market, and effectively communicating product value to healthcare decision makers.

To do this, Pharma market access teams must generate a comprehensive evidence base and demonstrate the clinical and economic value of their technology to reimbursement bodies, healthcare budget holders and, ultimately, prescribers.

How we support our Pharma clients

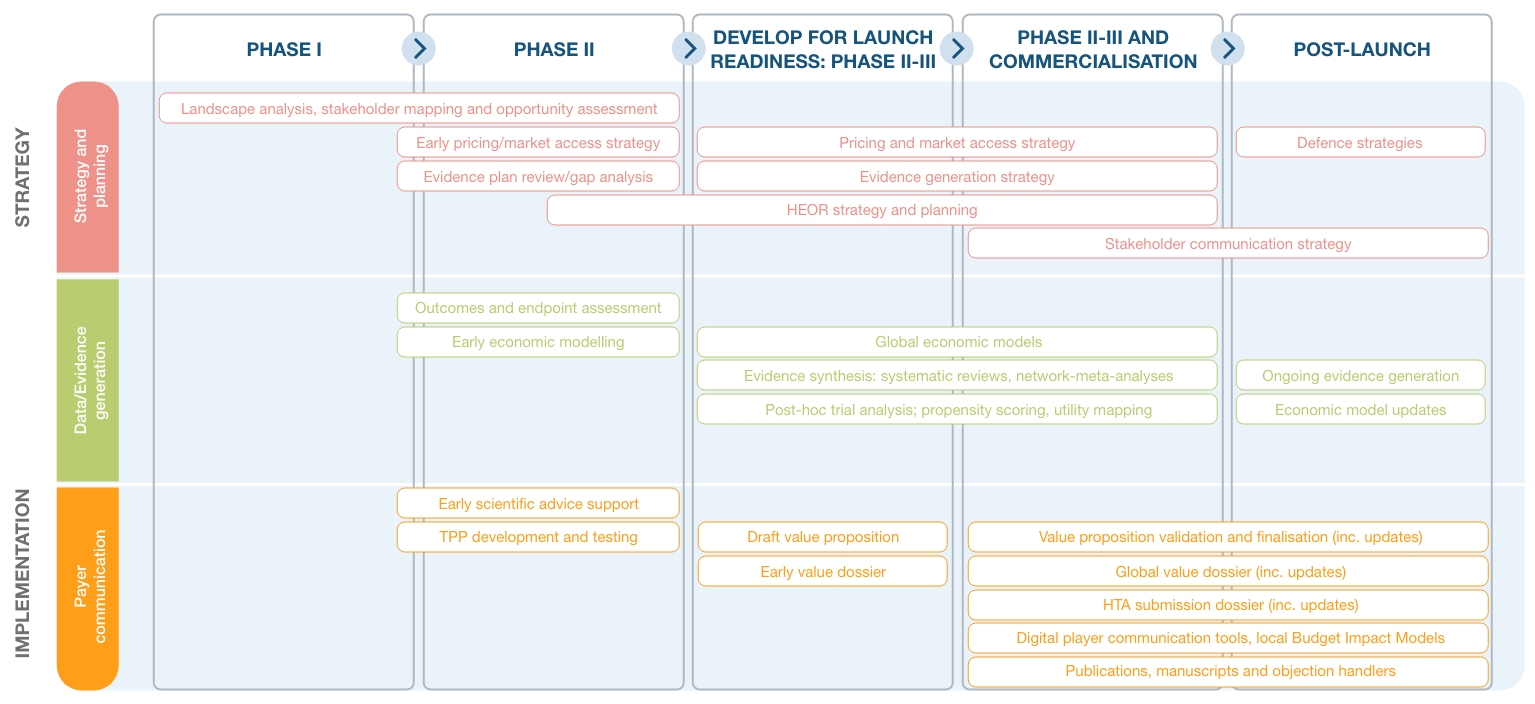

Our expert Pharma market access consultants and HEOR specialists support large, mid-size and smaller Pharmaceutical companies with each stage of the market access journey, from strategy to implementation.

With expertise across a wide range of disease areas and specialist teams in-house to support with all tactical needs, we are able to support our Pharma clients throughout their product lifecycle:

Click on the image to enlarge

To discuss your Pharma Market Access needs with our experts, get in touch using the form below.

Strategic partners for key market access milestones

We partner with Pharma market access and HEOR teams across all global and local milestones, providing the strategy, insight, evidence, and materials to ensure commercial success.

Phase 2

Is there a market for this product? Is there likely to be a return on investment of clinical trials? What is the reimbursement potential?

Recommended approach:

- Opportunity assessment

- Competitor landscape analysis

- Payer landscape analysis

- Price and reimbursement potential analysis

- Early health economic evaluation and modelling

Outcome: Decision-making and the foundations of future market access supported by evidence and strategic insight.

Phase 2-3

What is the strategy to take this product to market? Where and how can we launch? What is our global pricing and reimbursement strategy?

Recommended approach:

- Market analysis (including competitor landscape analysis, insights from analogous products, and analysis of prior health technology assessment (HTA) or reimbursement decisions)

- Target product profile testing

- Price benchmarking and testing

- Market access strategy development

- Evidence generation plan development

- Competitor defence strategy

Outcome: A comprehensive strategy for global market access that is driven by market, competitor, and payer insights.

Phase 3 to launch

Do we have the value messaging and evidence to secure reimbursement in key markets?

Recommended approach:

- Value proposition development (with payer validation)

- Evidence synthesis via systematic literature review, network meta-analysis, and/or indirect treatment comparisons

- Health economic models (e.g. cost-effectiveness model and budget impact model)

- Value dossier and objection handler

- Hosting of materials on global value platform

- Publication strategy and development

- Roll out of global value materials to local affiliates and support with local adaptation for key markets

Outcome: Impactful messaging, value materials, and evidence ready for local affiliates launches.

Phase 3 to launch and beyond

How do we secure HTA recommendations across the UK and Ireland?

Recommended approach:

- Evidence review and gap analysis, review or development of health technology assessment (HTA) strategy

- Starting in England: National Institute for Health and Care Excellence (NICE) HTA submission – full HTA support, including systematic literature reviews (clinical and economic), cost-effectiveness models (CIMs) and budget impact models (BIMs), advisory boards, expert elicitation, submission dossiers, and post-NICE submission services, such as mock meetings and scenario analysis

- Moving to Scotland: Scottish Medicines Consortium (SMC) submission – adaptation of NICE submission to meet SMC requirements (e.g. update of CEMs and BIMs) and incorporation of key learns from NICE submission and any newly published evidence

- Then to Ireland: National Centre for Pharmacoeconomics (NCPE) submission adaptation of NICE/SMC dossiers to meet NCPE requirements (e.g. update of BIMs) and key learns

- Commercial launch plan review – sharing learnings from HTA process for local market access teams

Outcome: Robust HTA strategies and submissions to secure approval in these key markets.

How do we launch this product in the key local market? What do we need to engage local payers?

Recommended approach:

- Development of launch strategy

- Review and analysis of global value materials and re-development for local market

- Ad board with local key opinion leaders

- Above-brand ‘case for change’ messaging

- Localised value propositions/narrative

- Localised economic modelling (e.g. budget impact model)

- Leave pieces/guidelines influencing pieces

- Price negotiation strategy and training

- Objection handling

- User guides for materials

Outcome: Comprehensive local market access strategy and engagement tools to support field team communication with local payers.

How do we navigate the UK healthcare system? What do we need to engage NHS decision-makers and drive change?

Recommended approach:

Recommended approach for launching in key local markets, plus…

- Service assessment and re-design support

- Advanced notifications/advanced budgetary planning

- Workshops on understanding the NHS environment

- Costed patient pathways

- Pre-launch field team training

- NHS stakeholder mapping

- Support and training on how to engage with different operational, strategic, and clinical stakeholders across the NHS

- Specific support for key NHS policies, e.g. specialised commissioning

Outcome: Strategy and insights needed to successfully engage NHS decision-makers and drive change.

Why choose Mtech Access to support your Pharma market access strategy?

- We have the in-house capability to support you through each stage of the product lifecycle or to supplement your teams’ capability where needed

- We confirm the principles and assumptions behind our work with a broad network of payers, clinicians, and other stakeholders across global markets

- In the UK we have close relationships with over 90+ contracted Associates working in the NHS, who work directly with us on projects to help us ensure our market access strategies and messages resonate with NHS decision-makers

- We combine evidence and creativity, to deliver resources that work for your teams

- We are a full-service Veeva partner, able to leverage Veeva’s full functionality to deliver the best possible experience for your teams and customers

Why choose Mtech Access to support your Pharma market access strategy?

- We have the in-house capability to support you through each stage of the product lifecycle or to supplement your teams’ capability where needed

- We confirm the principles and assumptions behind our work with a broad network of payers, clinicians, and other stakeholders across global markets

- In the UK we have close relationships with over 80 contracted Associates working in the NHS, who work directly with us on projects to help us ensure our market access strategies and messages resonate with NHS decision-makers

- We combine evidence and creativity, to deliver resources that work for your teams

- We are a full-service Veeva partner, able to leverage Veeva’s full functionality to deliver the best possible experience for your teams and customers

Featured Case Studies

-

View case study

Delivering on global market access strategy, evidence generation and communication objectives

-

View case study

Challenging European policy proposals with an evidence-driven submission on behalf of a cross-industry consortium

-

View case study

Modelling pricing and market dynamics in a competitive therapeutic landscape across the EU4 and UK markets

-

View case study

Gaining global payer insights to inform clinical trial design, price and market access strategy

-

View case study

Building a budget impact model for AMCP submission in the US

-

Read case study

Researching market access pathways, reimbursement requirements and implications of orphan drug designation for a rare disease product

-

Read case study

Developing a digital toolkit to demonstrate the value of a pharmaceutical technology to secondary care providers

-

Read case study

Reviewing HTA decisions in key markets across the globe

-

Read case study

Gaining European payer insights with an advisory board

-

View case study

Conducting market research into the UK private healthcare market to inform market access and pricing strategy

Articles related to Pharma Market Access

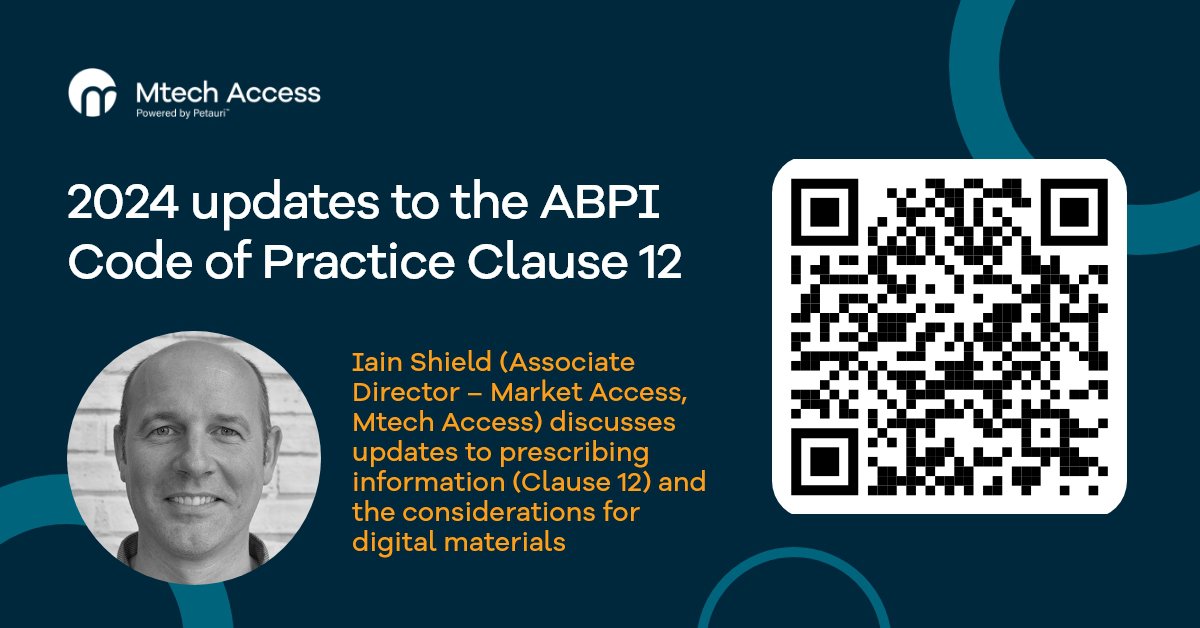

2024 updates to the ABPI Code of Practice Clause 12

Iain Shield (Associate Director – Market Access, Mtech Access) discusses updates to prescribing information (Clause 12) in the ABPI Code of Practice and the considerations for digital materials…

AMCP dossier planning for US market access and reimbursement

What is an AMCP dossier and how are they used in US market access? Drawing on their extensive experience compiling AMCP dossiers, here, our global market access experts explain when, why and how…

Which strategic market access activities do you consider essential?

Our global market access experts have put together this framework of activities for successful market access. Download the PDF summary…