Petauri Evidence is an innovative new business unit within the Petauri platform that unites Mtech Access and Delta Hat. Together, we are dedicated to helping pharmaceutical, biotechnology, and medical device companies generate, apply, and communicate evidence to inform healthcare decision-making. Find more details here.

We partner with market access and HEOR teams across all global and local milestones, providing the strategy, insight, evidence, and materials to ensure commercial success.

Phase 2

Outcome: Decision-making and the foundations of future market access supported by evidence and strategic insight.

Phase 2-3

Outcome: A comprehensive strategy for global market access that is driven by market, competitor, and payer insights.

Phase 3 to launch

Outcome: Impactful messaging, value materials, and evidence ready for local affiliates launches.

Phase 3 to launch and beyond

Outcome: Robust HTA strategies and submissions to secure approval in these key markets.

Outcome: Comprehensive local market access strategy and engagement tools to support field team communication with local payers.

Recommended approach for launching in key local markets, plus…

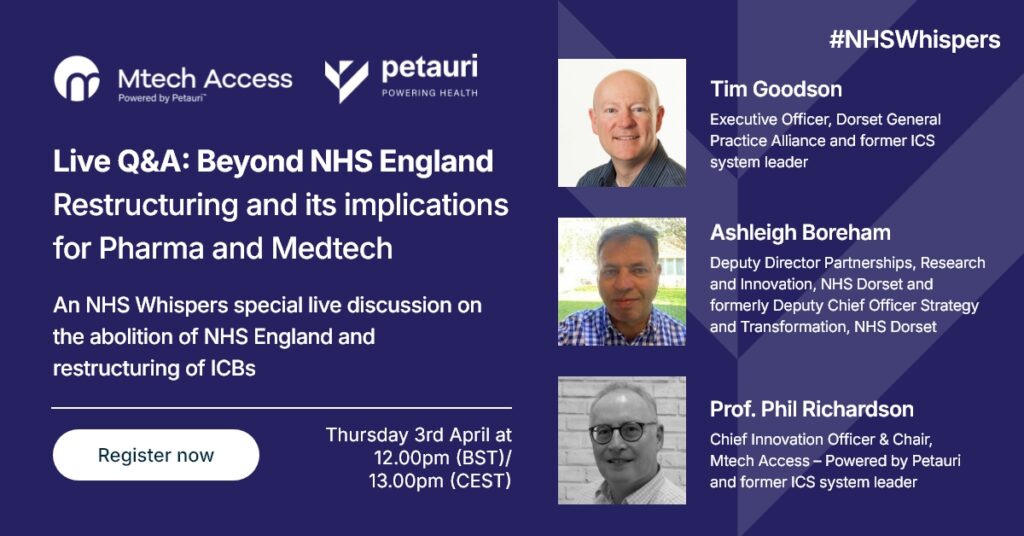

Outcome: Strategy and insights needed to successfully engage NHS decision-makers and drive change.

We provide strategy and solutions to help Pharma and Medtech companies bring interventions to market, providing more patient choice and meeting the needs of the healthcare environment.

Our consultants and technical experts support global teams and affiliates throughout the product life cycle, from evidence generation and strategy to communication of value.

United Kingdom

Germany

France

Italy

Spain

Canada

USA

Australia

China

Japan

CASE STUDY

Our client’s global market access team were looking for a consultancy who could support them from strategy to implementation. As the client was in the early stages of developing a new product, they first wanted to understand the challenges and opportunities that their new treatment would face when launching in different markets.

Download a PDF brochure and share our story with colleagues

At Mtech Access we are always striving to engage with the wider market access community and share our thoughts on the latest industry issues or methods development.

Explore the reimbursement landscape across key markets with our free introductory guide